Rescue our Children from Government Schools

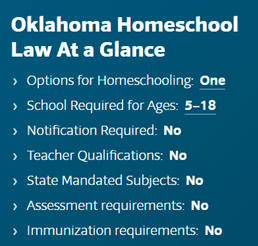

Homeschooling is legal and straightforward in Oklahoma. Churches can engage in any of the possibilities suggested by Public School Exit

FREE download at www.PublicSchoolExit.com

Best legal advice: https://hslda.org/legal/oklahoma

OKLAHOMA’S HOME SCHOOL, CHOICE AND SCHOLARSHIP PROGRAMS

With the Oklahoma legislature and Supreme Court leaning toward conservativism, homeschool is a breeze. It is not regulated and does not require parents to register with or seek approval from state or local officials. There is no required state approved curriculum, but a well-defined curriculum or design for learning should be implemented. Required school subjects under Oklahoma law include reading, writing, math, science, citizenship, US constitution, health, safety, physical education, and conservation.

GOVERNMENT RESOURCES: Families can use public resources to receive education outside of their neighborhood schools with unprecedented choice among public and private school options. Note: PSE considers government funding helpful in the short run but may cause implications in the future. We recommend Public School Exit programs with no government intervention.

OK STATE DEPARTMENT OF EDUCATION

Homeschool – Great Encouragement to Homeschool – https://sde.ok.gov/home-school

HSLDA – HOMESCHOOL GRANTS

https://hslda.org/community/grants-for-homeschooling

HSLDA Compassion Grants help homeschool families continue homeschooling through difficult times. Since 1994, they have given over 15,000 grants to families facing natural disasters or struggling through financial hardships.

TAX-CREDIT SCHOLARSHIP

Oklahoma Equal Opportunity Education Scholarships or K-12 – The Oklahoma Equal Opportunity Education Scholarship program offers individuals and businesses a 50 percent tax credit tax credits for donations to scholarship-granting organizations (SGOs), nonprofits that provide private school scholarships to students who meet the income and/or zoning requirements as well as “educational improvement grants” to public schools. Oklahoma’s tax-credit scholarship program for low- and middle-income students helps thousands of students access schools that are the right fit for them.

Statewide, only 0.5 percent of students participate in one of Oklahoma’s private educational choice options https://www.edchoice.org/school-choice/programs/oklahoma-equal-opportunity-education-scholarships/

SCHOLARSHIPS FOR DISABILITIES

Oklahoma’s Lindsey Nicole Henry Scholarships for Students with Disabilities provide students with special needs, in foster care and/or those adopted out of state custody school vouchers to attend a private school of their parents’ choice. Students must have or qualify for an Individualized Education Plan or an Individualized Service Plan to participate

SCHOOL CHOICE

Private School tax credit Scholarships from K-12: https://osfkids.org/

Tax-credit scholarships, sometimes called scholarship tax credits, are different from other school choice programs, such as school vouchers. What sets them apart? Tax credit scholarships uses only privately donated money, whereas vouchers reach into state coffers, and the scholarships can be sought at any participating school.

Oklahoma Expands School Choice Scholarship Program

Charter Schools, Vouchers, Private Schools, Equal Opportunity Education Scholarships

For a more complete description on Oklahoma’s for State Scholarship and School Choice programs, please email us at contact@publicschoolexit.com